VP Law Firm • dec 09, 2021

Businesses on a mission – a brief guide for switching to e-invoicing

The long-awaited introduction of electronic invoices, and the broader changes to how payments between companies operate, have become a reality with the adoption of the Electronic Invoicing Law (Official Gazette of the Republic of Serbia, No. 44/2021, ‘the Law’). Experts believe this piece of legislation will cause the most wide-ranging systemic changes to the Serbian economy since the early 2000s.

Given the broad scope of the Law and the nearly dozen byelaws it envisages, it seems some clarification for businesses may be in order, as evidenced by the not insignificant number of consultancies cropping up to either assist firms in making the switch or provide e-invoicing services on their behalf.

This article, therefore, is intended as an explanation for business owners of how to approach the new e-invoicing system, how the framework will operate, and what its requirements and benefits will be.

| An electronic invoice is a demand for payment in a transaction with consideration, any other document relevant for the action of paying or amount of payment, or an invoice issued in a transaction without consideration or for advance payment received, that has been issued, sent, and received in a structured format that permits fully automated electronic data processing using the electronic invoicing system (‘electronic invoice’ or ‘e-invoice’). |

- > Who is required to issue and accept e-invoices?

The Law is quite clear and unambiguous in terms of which entities will be required to issue e-invoices, and this clarity will in itself allay any doubts amongst businesses unsure if the legislation applies to them.

The requirement to issue, accept, register, and retain e-invoices will apply to:

1) public-sector entities, in mutual transactions and in transactions with private-sector entities;

2) private-sector entities (value added tax payers), in mutual transactions and in transactions with public-sector entities; and

3) tax agents acting on behalf of foreign firms operating in Serbia within the meaning of value added tax regulations, in transactions with public- and private-sector entities.

To additionally clarify these provisions we need to explain what is meant by ‘public-sector entity’ and ‘private-sector entity’. Public-sector entities are general government bodies and state-owned enterprises, whilst private-sector entities, as referred in the Law, are exclusively value added tax (VAT) payers.

Apart from mandating e-invoicing for these groups, the Law also allows entities not formally required to engage in e-invoicing – sole traders and other businesses that do not pay VAT – to opt into the electronic invoicing system.

The Law envisages a set of exemptions from the e-invoicing requirement: retail transactions and advances received against retail transactions within the meaning of the Fiscalisation Law; contractual obligations binding on beneficiaries of funds under international framework agreements; and procurement, modernisation, and refurbishment of arms and military equipment, purchase of security equipment, and related procurement of goods or services.

These exemptions are exhaustive and minimal, so e-invoicing is likely to extend to most of the economy.

Apart from mandating the issuance and receipt of e-invoices, the Law also requires VAT to be recorded electronically.

Value added tax debtors, VAT payers, and public-sector entities, private businesses, and sole traders that are not VAT payers are all required to record VAT electronically, with the following exceptions:

- VAT payers, for goods or services transactions, including advance payments received against such transactions, for which they have issued e-invoices pursuant to the Law; and

- tax debtors, for imports of goods.

In addition, VAT must be recorded electronically for retail transactions entered into by VAT payers and advance payments received against such transactions only if those transactions, including such advance payments, do not require issuance of fiscal receipts within the meaning of the Fiscalisation Law.

- > How long do businesses have to comply with the law?

The Law will be binding, but the affected businesses will be required to comply with them in stages. This phased approach speaks to the complexity of the procedure and is intended to make it easier for firms to become used to the new requirements.

The Law will become effective for various transactions on three different dates:

| ⌛ 1 may 2022 |

Private-sector entities → start issuing e-invoices to public-sector entities; Public-sector entities → start issuing e-invoices → to other public-sector entities; Public-sector entities → start accepting and retaining e-invoices; |

| ⌛ 1 July 2022 |

Private-sector entities → start accepting and retaining e-invoices; Private-sector entities → start issuing e-invoices → to private-sector entities; |

| ⌛ 1 January 2023 |

Private-sector entities → start issuing e-invoices → to other private-sector entities; |

In another likely bid to help businesses comply, the Law has entered into effect almost one year before the first firms will be required to issue or accept e-invoices. This extended familiarisation period will help companies become acquainted with the new rules and implement them, as well as allowing the government sufficient time to enact byelaws that will regulate the issue in greater detail.

Even though the Law had initially been scheduled to become effective for the first category of transactions on 1 January 2022, citing ‘a large volume of requests for extension from entities reporting they needed more time to adjust to the new model’, on 1 December 2021 the Ministry of Finance publicly announced it would amend the law to push its effective date back.

The current arrangements, however, remain in force until the Ministry’s amendments are adopted by Parliament.

- > What will e-invoices look like and what elements must they contain?

|

Registered Name/Abbreviated Registered Name of the recipient Number, date, and place of issue of invoice – Type and quantity of goods or services supplied; *Reference to statutory provision exempting transaction from VAT Name of issuer |

The Law treats electronic and paper invoices equally: any invoice issued electronically must contain all elements required of a physical paper invoice.

The rules also stipulate mandatory elements of e-invoices that increase/reduce periodic fees and reverse e-invoices.

An e-invoice that increases or reduces a periodic fee must contain:

- Name, address, and Taxpayer Identification Number (TIN) of the issuer;

- Name, address, and TIN of the recipient;

- Number and date;

- Amount by which the periodic fee is to be increased/reduced;

- Number of e-invoice for the supply of goods or services, or beginning and end date of the period in which multiple e-invoices have been issued, if the change affects all invoices issued in that period.

A reverse e-invoice must contain:

- Name, address, and Taxpayer Identification Number (TIN) of the issuer;

- Name, address, and TIN of the recipient;

- Number and date;

- Number of e-invoice for the supply of goods or services, or beginning and end date of the period in which multiple e-invoices have been issued, if the change affects all invoices issued in that period.

In addition to these data, the Law permits invoices to also contain information required by other rules (such as the VAT Law) or other information relevant to the issuer, recipient, or other stakeholders.

- > Will e-invoices be enforceable?

E-invoices will be deemed ‘authentic instruments’ in enforcement procedures. In other words, creditors will be able to seek enforced collection pursuant to e-invoices on condition that the issuer has sent the invoice to the recipient via the e-invoicing system, or that an information intermediary has done so on behalf of the issuer.

- > Electronic Invoicing System

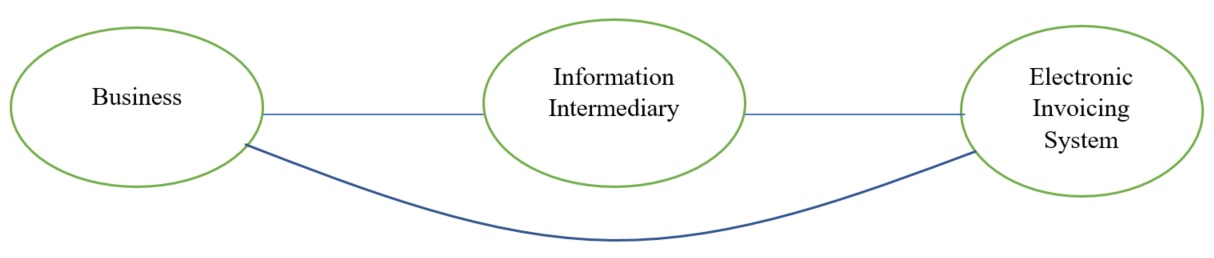

To generate, send, register, process, accept, and retain e-invoices, businesses will use the Electronic Invoicing System (EIS), an IT solution managed by the Central Information Intermediary.

The EIS will be available to all stakeholders free of charge. Since one objective of the Law is to enhance government oversight, the Central Information Intermediary that will manage the EIS will be part of the Ministry of Finance.

Business will be also able to contract with other information intermediaries, who must be approved by the Ministry of Finance. The requirements for this approval are discussed in greater detail below.

One advantage of this system is that it permits e-invoices to be retained indefinitely for later access.

Since the Law only regulates the basic concept of the EIS, the Ministry of Finance has enacted a byelaw that governs registration on the system, its use, and access to data contained in it.

- > Registration, features, and operation of the Electronic Invoicing System

Accessing the system requires having a TIN and registration using a web app. Businesses must be registered by their statutory representatives, whilst sole traders have to register personally. The applicant’s identity will be verified via the Electronic Identification Portal.

On question how to access the System, you will get an answer by clicking on the following link https://vp.rs/wp-content/uploads/2021/12/Scheme.pdf which will introduce you to the timeline of all necessary actions. If you have taken all the steps, the resulting “product” is your user account on the System.

When registering, applicants can choose whether they intend to access the EIS directly ili via an information intermediary, depending on which they will be asked to provide information about the person authorised to access the system using the user interface or the information intermediary that will access the system on their behalf. One registered business can have only one active information intermediary at any given time. The firm’s access privileges for the EIS are in effect transferred to the intermediary if this indirect option is chosen.

Firms that choose to access the EIS directly can do so using either:

1) the user interface (in an internet browser); or

2) an application programming interface (which links the system with the company’s software).

If the EIS is used to issue an electronic invoice for an as-yet unregistered recipient that has a TIN, the recipient is automatically registered by the EIS. The e-invoice will be issued, saved, and delivered to the recipient if the recipient is legally required to accept an electronic invoice for the transaction in question.

- > Information intermediaries

As already noted, each business can choose to use an information intermediary, to which it transfers its access privileges for the EIS. The information intermediary will access the EIS on behalf of the firm and manage its e-invoices.

To obtain approval from the Ministry of Finance, information intermediaries must be Serbian-registered businesses that meet requirements set out in the relevant Ministry of Finance byelaw. They will be listed in a publicly-accessible Register of Information Intermediaries.

A prospective information intermediary applying for approval must meet the following conditions:

- Being a legal entity registered in Serbia;

- Not having any outstanding tax liabilities;

- Not having as a statutory or other representative a person convicted of property crime, economic crime, cybercrime, offences against government authorities, forgery, or abuse of office, corruption, or fraud whilst in office;

- Not having been finally convicted of a criminal offence as a legal entity;

- Having safeguards in place that apply to critical ICT systems operators and having adopted an internal document on critical ICT system security, pursuant to legislation governing cybersecurity;

- Not having had its information intermediary approval revoked previously;

- Having enacted an internal document governing the provision of information intermediary services; and

- Having enacted an internal document governing the provision of information intermediary services, which must include safeguards for data storage in the intermediary’s electronic invoicing system and must designate a location in Serbia for storage of such data.

Applications may be filed only electronically, and the Ministry of Finance has a 15-day window to respond. Approvals are valid for 24 months.

- > Retaining e-invoices and converting them into physical documents

The EIS will indefinitely retain invoices issued or received by public-sector entities, whilst invoices issued by private firms will be retained for ten years from the end of the calendar year in which the invoice is issued, either in the EIS or in the intermediary’s own system, depending on the type of access selected.

A private business that has issued or received an e-invoice may export it electronically or print it into as many copies as required for the duration of the mandatory retention period. To ensure authenticity of origin and integrity of content, any printed invoice must:

- Contain all elements of the electronic invoice, including a message to the effect that the electronic invoice is generated in the electronic invoicing system, the unique invoice identifier, and the date and time of issue;

- Display all mandatory elements legibly;

- Be downloaded and printed pursuant to the provisions of regulations on electronic documents that govern the downloading and printing of such documents.

According to Article 5 of the Electronic Invoicing Law, invoices issued by public-sector entities and private companies that do not use separate information intermediaries are retained in the EIS using procedures and technical solutions that ensure authenticity of origin and integrity of content of any electronic invoice downloaded from the EIS whilst meeting cybersecurity requirements and standards set out in cybersecurity regulations.

The same standards apply to the retention of invoices issued by private-sector entities that employ information intermediaries, with the added requirement that the information intermediaries must provide appropriate protection of the data from loss, tampering, and unauthorised access.

- > Invoice Management System

Unlike the EIS, the Invoice Management System is intended for public-sector entities.

Public-sector entities with multiple levels of approvals may receive e-invoices via the Invoice Management System, a web app administered by the appropriate Government service.

- > Penalties for non-compliance

The Law envisages also envisages penalties for non-compliance.

Businesses may be fined from 200,000 do 2 million dinars, and sole traders between 50,000 and 500,000 dinars, if they:

- Fail to issue electronic invoices where these are mandatory;

- Use data from the EIS for purposes other than those envisaged by the Law;

- Fail to accept electronic invoices where mandated by the Law;

- Fail to retain electronic invoices where mandated by the Law;

- Do not permit an authorised inspection officer to perform an inspection.

Non-compliance will also result in a fine of between 50,000 and 150,000 dinars for the authorised officer of the business or public-sector entity.

Information intermediaries may be fined between 200,000 and 2 million dinars if their actions jeopardise the security and operation of the EIS.

- > Benefits of e-invoicing

| Easier retention and access | The EIS will retain invoices for ten years, which will allow entities to search invoices whenever necessary and access them easily at a later date. This in effect means that no invoice will ever be lost again. |

| Greater transparency | Authorities can ask to inspect any e-invoice, which will promote transparency and stave off claims that an invoice was never issued. |

| Faster delivery | By eliminating conventional means of communication, e-invoicing will greatly reduce the time needed to deliver invoices. |

| Cost savings | The shift away from mailing invoices will result in significant savings on items such as paper, printing, envelopes, stamps, certificates of mailing, return receipts, postage. |

| Quicker collection | Faster invoice delivery will allow recipients to pay whet they owe more quickly. |

| Guaranteed authenticity and integrity of invoices | All entities are guaranteed authenticity (by means of electronic signatures) and integrity (invoices cannot be tampered with). This guarantee means that, once generated, an invoice can be changed only if it is reversed and a new one issued. |

| Simpler storage | Whilst printed invoices require physical space, folders, and filing cabinets, e-invoices are sets of noughts and ones on a computer disk. This results in tangible savings and simpler storage procedures. |

| Opt-in access | Non-VAT payers are not required to use the EIS but may opt in. If they choose to use the system, they must continue to do so for the duration of that and the subsequent calendar year. |

Businesses will need a great deal of effort to comply with the Electronic Invoicing Law, but the significant benefits from switching easily outweigh the stress of the learning curve, all the more so since making the change is only a matter of time and habit whilst the advantages to the government and businesses will remain ever present.

Download the full text here.