Goran Tomašević • nov 24, 2021

Costs of the Enforcement Proceedings

I. Introduction

Enforcement proceedings are an integral part of any legal system. Although, the public opinion on enforcement proceedings is mostly negative, try to imagine a legal system without enforcement proceedings. Try to imagine living in a legal system that cannot enforce courts’ decisions, or a legal system where the exercise of your right depends solely on the will of someone else (for example, imagine your work compensation depending solely on your client’s will). You must agree, that isn’t exactly a world you would enjoy living in. Of course, this doesn’t mean that the way this procedure is regulated in our system should not be reconsidered and further improved.

In any case, enforcement proceedings are often the only way to exercise your right by force, even if it was guaranteed by a final court decision or resulted from a credible document (bill of exchange, invoice).

When we talked about Costs of civil litigation, we pointed out that a final civil decision passed in favor of a party is often only the first stop on the path to exercise rights. In order to exercise their right, the parties will often have to go a step further and initiate enforcement proceedings. It is of course important for the parties to understand what this step means for them (in terms of costs and duration of the procedure) before deciding on it.

The issue of the costs can be just as important to you if you find yourself in a position where you have no choice but to try to enforce your invoices, or if you want to use the debtor’s personal bills of exchange that the accountant told you could not simply “charge”. This issue is no less important if you want to choose the right collateral in order to make your business safer, or to reduce potential pressures on the liquidity of your business.

On the other hand, if you have forgotten to settle a debt or pay a parking ticket, and there is a warning of filing a lawsuit awaiting you in the mailbox, it is equally, if not more important for you to understand the total costs of enforcement proceedings that you have been “kindly” warned about.

Therefore, whether you want to forcibly settle some of your claims (monetary or non-monetary) determined by a final decision, or a claim arising from another enforcement or credible document; whether you are thinking about the liquidity of your company, or you are hesitant to act on a warning before a lawsuit, it is advisable to familiarize yourself in detail with the rules on the costs of enforcement proceedings.

The concept, types and the amount of costs of enforcement proceedings will be explained as follows, with answering the two main questions:

Who and when bears the costs?

II. Concept of the enforcement proceedure costs

Costs in the enforcement proceedings are all costs incurred from the moment of initiating enforcement proceedings until its completion which are necessary for conducting the procedure itself.

III. Types of the enforcement proceedure costs

The costs can be devided into attorney’s fee, court costs and costs incurred before the public bailiff.

i. Attorney’s fees

The enforcement creditor initiates the enforcement procedure by submitting enforcement proposal that he can compile and submit himself or he can do it through an attorney. All other actions in the enforcement procedure can be taken by the creditor himself or by an attorney on his behalf. If he chooses to hire an attorney, he will have to pay attorney fees.

The enforcement debtor also has the possibility to perform all actions in the enforcement procedure through the attorney, which means that certain legal costs will arise for him as well.

Attorney’s fees are calculated in accordance with the Attorney’s Tariff.

ii. Court costs

As previously stated, enforcement proceedings are initiated by submitting enforcement proposal to the court. This creates the obligation of paying the court fee for said proposal. Based on the proposal, if all the conditions are met, the court delivers a decision on enforcement, requiring payment of another court fee.

The court calculates fees on the enforcement proposal and the decision on enforcement in accordance with the Law on Court Fees, and it issues an order to the enforcement creditor to pay them within a certain deadline.

There are cases when court costs will not be incurred, such as when the procedure is initiated against the Republic of Serbia, or when the proposal for the enforcement is submitted directly to the public bailiff.

iii. Costs incurred before the public bailiff

After issuing the decission on enforcement, the court then hands over the case to the competent public bailiff in order to further conduct the procedure. The public bailiff is entitled to his success fee as well as reimbursement of all actually incurred costs recorded for work performed.

a. Success fee

Success fee includes the following costs:

- preparation, management and archiving of the case fee (hereinafter: initial advance) – As soon as the case is brought to the public bailiff, he will calculate the initial advance and order enforcement creditor to pay the amount within a certain deadline. The payment of he initial advance cannot be avoided by the creditor;

- fee for undertaking individual actions – After the case is submitted to the public bailiff, every action taken by the bailiff within the procedure is charged, that is, the creditor is ordered to pay these costs. The amount of costs on this basis depends on the number of actions taken in the enforcement procedure by the public bailiff (the principle is – the more actions performed, the higher the costs);

- successful implementation of the enforcement proceedure fee (hereinafter: reward) – The reward arises when the public bailiff collects at least partial claim from the debtor. The amount of this fee depends on the amount of the claim that has been settled.

b. Reimbursement of actually incurred costs recorded for work performed

In addition to aforementioned costs, public bailiff is also entiteld reimburesement of actually incurred costs recorded for work performed (such as transportation costs in case of field work).

The costs incurred before the public bailiff are calculated by the bailiff and the enforcement creditor is ordered to pay them.

IV. The amount of costs of enforcement proceedings

As already mentioned, the amount of costs of enforcement proceedings is determined in accordance with the relevant regulation:

- Attorney’s Tariff;

- Law on Court Fees;

- Public Bailiff’s Tariff;

In the case of estimated receivables, costs depend on the amount of claims (the higher the claim, the higher the costs), certain fixed amounts of costs are prescribed as well.

Also, both attorney and public bailiff costs are increased in case more persons are on the side of the enforcement creditor and/or enforcement debtor.

In addition, there are prescribed limits that enforcement costs cannot exceed, but also certain grounds for reducing certain items or exemption from certain costs are prescribed.

V. Who and when bears the costs of enforcement proceedings?

Bearing of the costs takes place in two phases – the advance payment phase and the transferring of the costs phase:

i. Advance payment

The basic rule is that the costs of the enforcement procedure are previously borne by the enforcement creditor – advance payment. This practically means that the creditor is obliged to pay each of the stated costs after they are incurred within the period in which he was ordered to pay them.

There are certain exceptions to this rule:

- The enforcement debtor (as well as the participant in the procedure) bears the costs of the attorney he has hired to represent him in the procedure, that is these costs are not borne by the creditor;

- If the enforcement proceedings was initiated ex officio, the costs of the proceedings will be advanced by the court from its own funds;

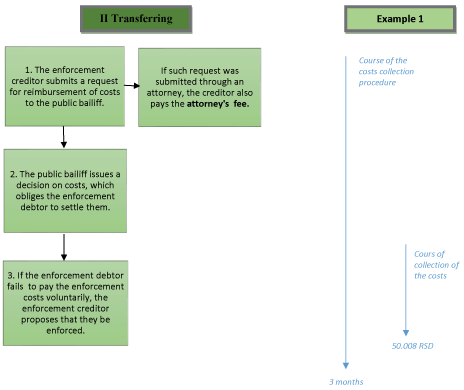

ii. Transferring of the costs

The second phase of transferring the costs, gives the possibility of the person who advanced the costs to transfer them to another person. In order to carry out the shifting, it is necessary to submit a request to the public bailiff, after which he will oblige the debtor to reimburse the advanced costs. If the debtor does not do so voluntarily, it is possible to enforce the collection of these costs from the debtor within the same enforcement procedure. However, whether the forced collection will be successful and to what extent, depends on the assets that the debtor has at his disposal.

a. Enforcement creditor

The basic rule is that the enforcement creditor bears the costs of the enforcement proceedings. However, the enforcement creditor has the option to pass on all costs incurred in the enforcement to the debtor. By transferring, the enforcement debtor becomes obliged to reimburse the enforcement creditor for all costs he has advanced.

However, the transfer of the costs does not occur automatically, it is necessary for the enforcement creditor to put in a request to the public bailiff. Such request should be submitted by the creditor within the prescribed period after the conclusion of the enforcement procedure. Based on the stated request, the public bailiff obliges the debtor to reimburse the creditor for all advanced costs of the enforcement procedure that the creditor requested.

In relation to the above, it is important to keep in mind that the public bailiff will not pass on to the debtor

- costs unjustifiably incurred by the enforcement creditor;

- as well as costs caused by unjustified conduct of two or more enforcement proceedings by the same enforcement creditor against the same enforcement debtor when the conditions for conducting one proceeding were met.

In addition to the enforcement creditor, the right to transfer belongs to the enforcement debtor and the participant as well, under certain conditions.

b. Enforcement creditor

The enforcement debtor may pass on the attorney’s fees to the participant in the proceedings (not to the enforcement creditor) only in exceptional situations within the enforcement proceedings themselves. However, within the framework of the enforcement procedure, the enforcement debtor shall bear its own costs and shall bear the costs of the enforcement creditor which shall be transferred. The enforcement debtor gets greater opportunities only in the event that the enforcement proceedings go into litigation and if he wins the dispute when, not only would he not bear the costs of the enforcement creditor, but also pass on his costs to the enforcement creditor. You can read more about the above in the previously published text Costs of civil litigation.

c. Participant in the procedure

Every person who exercises his right or legal interest in the enforcement procedure, and is neither an enforcement creditor nor an enforcement debtor – participant in the procedure, has the right to be reimbursed for the costs. As in the case of an enforcement creditor, a participant in the proceedings must request that the costs of enforcement be reimbursed.

VI. Conclusion

Bearing in mind all the above, it can be concluded that the costs of enforcement proceedings include court, attorney and public bailiff costs. As we have pointed out, these costs are not incurred at the same time but successively during the procedure. All costs are previously borne by the enforcement creditor (except for the attorney’s fees of the enforcement debtor and participants, which they themselves previously bear). Enforcement costs may be transferred by the enforcement creditor to the enforcement debtor through a request to the public bailiff (except for costs that are unreasonably caused or which are a consequence of conducting two or more proceedings that could have been combined). The enforcement debtor shall bear his own costs, and in case of transfer, the costs of the enforcement creditor. The enforcement debtor can never pass on his costs to the enforcement creditor unless the enforcement turns into litigation.

Therefore, whether you are a potential enforcement creditor or debtor, or whether you are their representative, in order to make the right decision to initiate or avoid enforcement proceedings, you need to be well acquainted with the types and dynamics of costs that may arise during enforcement proceedings, as well as with basic rules on their calculation. In that sense we hope you found this text useful.

We should note that for potential creditors, in addition to the calculation of the costs of the procedure, the previous analysis of the possibility to collect claims is equally important, both the initial claim and the costs of the enforcement procedure, which will be discussed in one of the following texts.

VII. Additional Examples and Schemes

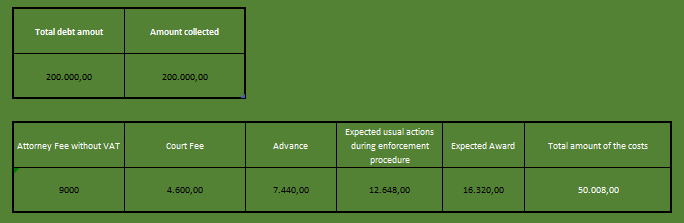

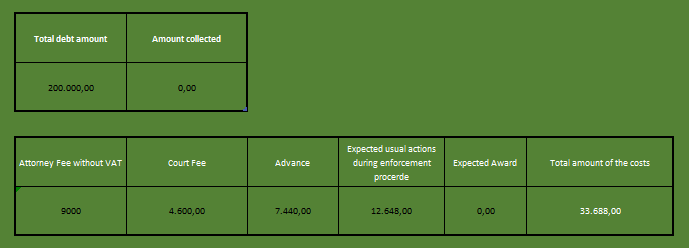

1) For durther clarification, below are examples that may help you gain a better idea of the amount and mutual relation of all individual categories of enforcement costs. These examples are based o the assumprion that the enforcement proceedings are conducted for the collection of claims in the amout of 200.000,00 RSD, and that the attorney submitted an enforcement proposal, but did not take additional actions in the proceedings.

Example 1 – the entire claim is collected in the amount of 200.000,00 RSD

Example 2 – the claim is not even partially collected

As shown in the examples, the costs are incurred in any case after the initiation of enforcement proceedings, regardless of whether the claim was collected in full or not at all (of course, in this case the costs are lower due to the award related to collected amount of receivables).

If you want to calculate the amount of your potential costs yourself, you will need to consult the aforementioned tariffs.

2) Presented below is a chronological overview of individual actions undertaken in the enforcement procedure (left column) along with the corresponding types of costs (right column) that occur in the phase of advaning costs (Scheme 1). Finally, we give a chronological order of the transferring of the costs (Scheme 2). Scheme 1 also includes a chronological overview of the costs of the procedure from hypothetical example 1. The dynamics of costs, ie. actions in the procedure, is given roughly, starting from the usual scenario for procedures in which enforcement is carried out on the executive debtor’s earnings. Of course, if the debtor does not have “easily confiscated assets”, the enforcement procedure can easily go beyond the time and financial framework given here. For the creditor, in addition to a clear idea of the dynamics of costs, which he will be obliged to pay during the procedure, it is equally important to correctly predict the dynamics of collection. That is why, in the same example, together with the chronological presentation of costs, we give an overview of the realized collection. We started from the assumption that the enforcement from example 1 was carried out by seizing half of the debtor’s salary, which amounts to 65.000,00 RSD. The dynamics of collection of the costs of the procedure from the same example is shown in Scheme 2.

Download the full text here.