Teodora Novković • feb 14, 2023

Successful implementation of the enforcement proceedings fee (reward)

I Introduction

Enforcement proceedings involve the procedure of forced collection of claims that a creditor has against a debtor. Enforcement proceedings are initiated by a motion for enforcement by a creditor, based on a specific enforcement title or credible document (e.g. invoice, promissory note, interest calculation, judgment or decision). Enforcement is determined by the competent local court, and is carried out by a public enforcement officer, all with the aim of efficient collection.

The costs of this procedure are an inevitable part of it, which both parties should be aware of, whether it is the creditor or the debtor. Read more about the concept of costs of proceedings and its importance on our website Costs of enforcement proceedings.

After the proceedings are initiated and the court issues an enforcement decision, which recognizes the court and lawyer fees, the case is assigned to the competent public enforcement officer.

During the enforcement proceedings, the public enforcement officer has the right to compensation for work during the implementation of certain actions aimed at collecting claims, or compensation for actual costs.

The public enforcement officers’ rate includes:

- – fee for preparation, management and archiving of cases;

- – fee for undertaking individual actions, which are charged according to the number of actions taken;

- – reward for successful implementation of the proceedings.

As for the reward for successful implementation of the proceedings, it is the final stage of the enforcement itself, that is, the moment when the enforcement debtor settles the entire claim as well as all the costs of the proceedings incurred until that moment, and it is also possible with partial settlements.

As all other enforcement costs, this one is ultimately borne by the debtor, whether he/she pays the amount voluntarily or through forced collection.

II Calculation of reward

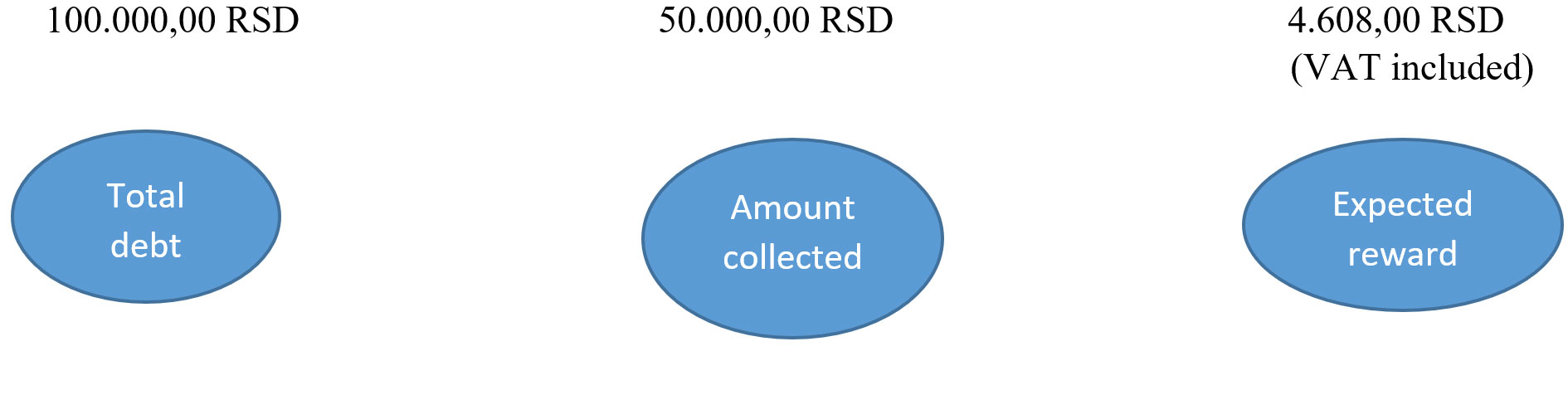

The reward is calculated in accordance with the tariff of public enforcement officers, in which the compensation for the successful implementation of the enforcement proceedings is determined in Tariff No. 3. Its amount depends on the amount of the settled claim, that is, it is calculated in proportion to the amount that has been settled.

When calculating, previously incurred costs before the public enforcement officer are not included.

Tariff No. 3

| Value in RSD | Success fee |

| up to 6.000 | 8 points from the value of collected claim amount |

| up to 12.000 | 12 points from the value of collected claim amount |

| from 12.000 to 30.000 | 20 points from the value of collected claim amount |

| from 30.000 to 120.000 | 22 points + 6% of the value of the collected amount of claims that exceed the amount of 30.000 |

| from 120.000 to 600.000 | 80 points + 5% of the value of the collected amount of claims that exceed the amount of 120.000 |

| from 600.000 to 3.000.000 | 335 points + 4% of the value of the collected amount of claims that exceed the amount of 600.000 |

| from 3.000.000 to 12.000.000 | 1200 points + 2% of the value of the collected amount of claims that exceed the amount of 3.000.000 |

| more than 12.000.000 | 3135 points + 1% of the value of the collected amount of claims that exceed the amount of 12.000.000, and up to 2.000.000 RSD |

Public Enforcement Officers’ Rate – table view

The compensation for the work of public enforcement officer is determined by multiplying the number of points with the value of a point and increasing it for the value added tax (VAT), if the public enforcement officer is subject to the VAT in accordance with the law.

The value of one point is 120 RSD without VAT.

Example

Bearing in mind that the compensation for successful implementation is defined in proportion to the amount of the claim that has been settled or achieved, a situation is possible in which the claim is only partially settled, and accordingly the public enforcement officer calculates the amount of the reward partially.

In the event that the remainder of the claim is settled later, the public enforcement officer may determine a new amount of compensation for the successful implementation of the proceedings, which will be calculated in accordance with the remaining collected amount.

III What happens after the reward is paid?

Phase of the proceedings

As mentioned above, the reward is calculated after the settlement of the claim and in proportion to the amount of the claim that has been settled. In most cases, the reward is calculated after the public enforcement officer prepares a conclusion on the end of the proceedings.

However, the dilemma for the debtors is why they are obliged to pay additional costs if the debt to the creditor is settled.

As a rule, the costs of enforcement are initially borne by the enforcement creditor, and accordingly, these costs are claimed from the enforcement debtor after submitting a request for compensation for the incurred enforcement costs, which also includes the advance payment of the reward.

The public enforcement officer then decides on the request for costs with a special decision on costs, and with that decision all the costs of the proceedings become final. It has the effect of a decision on enforcement, so in this regard, the amount of the claim determined by it can be settled through forced collection.

Therefore, all costs mentioned in the decision on costs do not represent anything new in relation to what was expected by the initiation of the enforcement proceedings and are exhaustively stated in the decision itself. After the costs are paid, the enforcement debtor has settled the entire claim against the creditor.

Decision on the conclusion of proceedings → Request for reimbursement of costs → Decision on costs.

This is a novelty compared to the previous Law on Enforcement and Security Interest, when all costs were charged directly to the enforcement debtor, which often posed a problem of setting costs and their transparency.

On the contrary, with regard to the decision on costs, the enforcement is carried out separately from the case that the public enforcement officer has already closed, and it refers to the collection of the costs of proceedings.

After the public enforcement officer makes a decision on costs, it has the effect of an enforcement decision, and, as stated above, it is also possible to conduct forced collection.

Is it possible to reduce the reward amount and when?

It is possible to reduce the reward amount in two cases prescribed by the law, namely:

– In the event the debtor settles the claim after the enforcement decision has been delivered to him, and no enforcement action has been undertaken (by 60%);

– In the event the enforcement was carried out by confiscation of funds from the debtor’s account (by 30%).

IV Exceptions to the right to compensation

There are cases in which the public enforcement officer is not entitled to a reward, namely when:

- The enforcement debtor settled the claim after submitting the motion for enforcement, and the decision on enforcement has not been receive by the enforcement officer.

- The enforcement debtor voluntarily surrendered the immovable property within 30 days from the date of delivery of the conclusion on its sale, and the public enforcement officer has no right to compensation for the successful implementation of the enforcement proceedings for the purpose of vacating and handing over the immovable property.

- If the request for the elimination of irregularities is founded, the public enforcement officer has no right to a reward, nor to the compensation for other actual costs in respect of the actions or decisions he undertook, or the decisions he made due to its adoption.

V. Conclusion

Bearing in mind all the above, it can be concluded what the reward actually is, how it is calculated and at what stage of the proceedings it is transferred, and accordingly, claimed from the enforcement debtor. Certainly, it is indicated that costs are not an arbitrary matter, that there are no additional or hidden costs after the decision on costs has been made.

It is necessary to mention that there is a distinction between the reward and other compensations for the work of a public enforcement officers, in the sense that the amount of the reward belongs to the public enforcement officer after successful enforcement, that is, it represents a reward for his work.

There are strict rules prescribed by law for determining the amount of the reward, as well as categorically stated exceptions when it is not determined, as it was previously explained., kao što je već objašnjeno.

Although the intention of the text is to offer solution to all the dilemmas that enforcement debtors are facing when it comes to this new mechanism, we also note the other side, i.e. the creditors and their representatives, who must take into account all the costs of the proceedings and their dynamics in order to make the right decision whether to initiate enforcement proceedings in the first place.